A few days ago I had an early morning phone call from a woman with a most courteous and congenial voice. She wanted to set up a rendez-vous. She said she had good news.

Even the news of good news from this woman was especially good. Why? Because the gentle voice belonged to none other than our French accountant.

News about France and its exploding tax regime forms either old or continually more depressing headlines these days. Income tax rates under the new, Socialist Président Hollande are surging up to 75%, friends keep telling us – as if we hadn’t heard. In fact one calculation made out that all in, once you count the barrage of social charges, France’s top rate will be more like 90%.

Rather precipitously, I said to my husband Philippe that whatever our accountant’s good news might be, we should bank it for next year.

Meanwhile, just to keep France’s economic forecast on a knife’s edge, in his early days as président, Mr Hollande has increased the minimum wage, introduced rent controls and is levying more taxes on big companies and banks. There was talk about amending the already hefty contribution à l’audiovisuel public to include not just the number of TVs in each household but also the number of computers. (Logic, if there is one: People check news on their computers.) At least this flagrant bid to stymie the French economy has failed at the last minute.

Mr Hollande has aimed these taxes at his own countrymen. As for the rest of us lot, he sought to impose an excruciating tax on foreigners who owned homes in France. Fortunately the EU courts have kept him on the right side of the law.

Life here in the Côte d’Azur often seems to run contrary to the convictions of the rest of the country, most famously in this area’s proportion of sunshine, and this year’s presidential election was no different. Voters in the département of the Alpes-Maritimes’ gave the more business-friendly Mr Sarkozy 64% of their votes, leaving only 36% to Mr Hollande. The mid-June legislative elections lurched even further to the right. Precisely none of the nine députés elected by this département hailed from Mr Hollande’s Parti Socialiste – or from any left-leaning party, for that matter.

In a country famous for its demonstrations but which finds all talk about money vulgar, one lesson Philippe and I have learned during our first few weeks back at Bellevue is this: If you’re fortunate enough to have it, don’t flaunt it. One friend, a rather glamorous French woman living in nearby Vallauris, was summoned to court a few months ago over a traffic accident that happened two years ago and that already had been consigned to the insurers’ completed files. The judge was interested in the fact that our friend drove an Audi cabriolet. Then he asked this ghastly question: How much does your husband make? My friend told him that her family does okay. She was slapped with a EUR 1,000 fine and lost her license for six months.

No matter the economic climate, few things are closer to French hearts, especially female French hearts, than essential esthetic services. On a recent trip to The Cutting Shop in Old Town Antibes, I discussed some rather delicate issues with my curly-haired technician. The salon typically has a long busy season, she said, with its location on a busy street near the world-class Port Vauban (and surely, if I can suggest it, because of its English name that must attract this yachtie clientele). But this year, she said, the first three months of The Cutting Shop’s busy season have been completely lifeless. Indeed, I then noticed a bunch of staff standing around in full whites with nothing to do. There’s no pedestrian traffic, she said, even though her friend at Port Vauban’s capitainerie says the docks are jam-packed!

(I find out separately that Port Vauban is, indeed, chockablock but for a less propitious reason: Many yachts are in dock with a single caretaker on board. The owners are going nowhere. That said, my source told me, there are early signs of improvement. The five-day superyacht charter (which used to last at least a full week) is coming into fashion again, with a subsequent couple-week villa rental. But even this luxury is a far cry from the heydays of five-week superyacht charters alongside concurrent villa lets that allowed the fortunate very-few to flit between two seven-star accommodations at the drop of a hat. Or the spin of the helicopter’s blades, as it were.)

So as the salon professionals in white stood around waiting, hoping, my technician explained that clients are only taking the necessary services. “L’épilation devient le luxe,” she said. Waxing, something that I thought was an out-and-out French necessity, is becoming a luxury. This news bulletin arrived two years after I was literally scolded in Antibes using a razor – lambasted to the core for causing two hairs to pop up where a single follicle should lie! Now I was learning that the French continue their épilations, but they alternate methods. One wax, one shave. One wax, one shave.

Indeed, my first stop after The Cutting Shop that day was the pharmacy. Before I even collected a shopping basket, I ran into a large, promotional stand for Veet, cire professionelle. Professional wax, sold on the cheap at Schlecker.

Still, life goes on in France. An English entrepreneur friend put it well. Despite the fact that she has lived in Antibes for something like six years, she describes herself as wholly English: an English person working in the English language in an English world that happens to be in France.

“I’m constantly amazed at how the French can do with so little,” she told me, making reference to some absurdly low monthly take-home pay statistic of the average French family. My very English friend was identifying the French ability to do something that we typically think is very British: To Carry On.

Philippe’s and my favourite produce seller at the bustling Marché Gambetta in nearby Cannes is case in point. Business this past winter was down 20% year-on-year, he told us while transferring our artichokes and carrots into a bag, but this June was his best ever. Then he paused from his work. Never mind all that, he said. The quality of life is excellent here in France. The newspapers just blow up the idea of a crisis.

The rendez-vous with our French accountant comes about just a few days after her phone call that was full of frankincense, myrrh and good news.

The good news? You’ve got it. Our taxes have fallen this year!

Whatever the gripes about France’s economic mess and the increasing sting imposed on French (and foreign) taxpayers, the wealth tax (or more precisely the ISF, l’Impôt de Solidarité sur la Fortune) that we owe to the French coffers for 2012 will only be a smidge more than half of what we paid last year. A smidge more than half!

I should point out that this payment is the largest component of the three taxes we pay to the French taxman as owners of a property here. The other two are les taxes foncières (for real estate) and the above-mentioned contribution à l’audiovisuel public, neither of which is insignificant. Still, things are looking better this year. We can thank Mr Sarkozy for the gesture.

But there’s more. “Je vous donne des bonnes nouvelles mais avec un bémol,” our accountant says. She’s giving us good news but with un bémol, literally a “flat” notation on a musical note. I get it: a hitch.

Her bémol is this: Watch out for next year. Président Hollande can change the wealth tax. Okay, no surprises there. But, she warns, he also can change it retrospectively. What’s more, French administrations actually do change tax rates retrospectively.

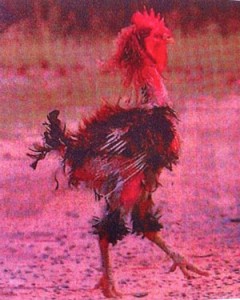

The accountant shares a joke circulating on French emails at the moment. The title:

Image du contribuable français en 2012

Picture of the French taxpayer in 2012

Beneath these words is a photo of a rooster, France’s unofficial national symbol. He’s trying to strut around ceremoniously, but it looks like his entire being has been mangled by the whirling blades of a lawnmower.

Beneath this poor excuse for a rooster is a caption: Le plus important, quand le fisc t’a plumé(e), c’est de toujours garder la tête haute! The most important thing when the tax authorities pluck you is to keep your head high!

In short, Carry On.

Needless to say, the notion of the plucked rooster has rendered Antibes’ property market lifeless. Offers are typically coming in 30-40% below listing prices. It seems that purchasers are willing to shoulder the economic uncertainties for a hefty discount. Homeowners almost certainly decline their offers. The future is unknown, so why sell out at such a discount?

Taking a direct hit, too, are Antibes’ museums, the most popular of which is the recently renovated Musée Picasso, gorgeously situated inside a former, 14th-century Grimaldi family château. Visitor numbers are up this year, but people are buying fewer souvenirs. Where they formerly bought a commemorative book, they now buy a postcard. Worse, the museum’s director told Philippe, his budget – contributed, of course, by the city of Antibes – has been hacked by 40% this year. Laying off French workers is next-to-impossible, so it’s his operating budget that has to take the full, body impact. Expenditures on exhibits, renovation and maintenance will get the brunt of it.

Case in point: I couldn’t figure out this season’s opening hours for Antibes’ Musée de la Tour. Philippe called his museum director friend. His response was particularly telling. “Le Musée de la Tour est un musée fantôme!” No one’s there anymore. Still, fingers crossed, the director may be able to get me inside.

Of course, it’s not all bad news around here. Five hundred jobs were created in Antibes-Juan-les-Pins this summer to accommodate tourism. More anecdotally Philippe and I were thrilled to discover a packed dining room a couple weeks ago at Cafetière Fêlée, one of our favourite restaurants in Antibes. Julian, the young chef, started his business three years ago. We’ve visited him ever since, often knocking around in his virtually vacant, stone dining room while feasting on his exquisite Asian-French fusion creations. Three years, he declared back then, was what he needed. Et voilà, this summer – despite any inkling of une crise économique – Julian has hired a second server, he’s axed his cost-cutting prix fixe menu, and Cafetière Fêlée’s future seems more assured than ever.

And there’s always système D (système débrouiller, discussed in last week’s post). Another Antibes-based friend runs a suite of wellness services, from acupuncture and osteopathy to meditation and neonatal support. But rather than employ everyone under one big, happy, corporate umbrella, she rents out her cluster of simple rooms by time slots and handles all the group’s publicity. The care providers, meanwhile, are self-employed. She manages a unique and award-winning business in a totally legal fashion that somehow manages to circumvent the most suffocating French laws on hiring, firing and taxation.

Still some folks – at least those in a position to do so, and therefore with reason to do so – have made their exit strategies. Our dear family doctor in Antibes declares that nothing good can come from the new Socialist government. He’s building a home in Ho Chi Minh City – his wife is Vietnamese – and already frequents his condo in lowly-taxed Hong Kong.

Lucile, our pilates instructor, agrees that business owners like herself don’t count for anything in France anymore. Fortunately her business hasn’t changed with the new government – except in a minor way. Two clients – both French women of significant wealth – said that if Mr Hollande was elected Président, they’d leave the country. Lucile had thought it was simply talk, but now one of the women lives in Switzerland. The other moved to Belgium.

The accountant’s bémol arrives just this morning. The same congenial voice that once delivered good news now resurfaces on the end of the telephone line as we’re eating breakfast.

Guess what, she says. Mr Hollande and his fine new fleet of fonctionnaires have just changed the tax rates!

The new government has changed the name of our amended wealth tax, too. It’s called une contribution exceptionnelle – like it’s a one-off. The extra money is due in November. “But half of France’s taxes are exceptionnelle, “ the gentle voice warns.

As for our accountant herself, she will officially retire next July at the age of 55.

Well, not exactly officially. More precisely, she will be fired. It’s all pre-arranged with her boss. But seeing that firing anyone is a sticky business in France, the company will pay her a nice wad. And there will be unemployment insurance as well, of course. Our accountant reckons she has paid for unemployment insurance for the past 35 years. She might as well get some of it back.

She adds, feigning confidence, that she’s going to look really hard for another job next year, but at her age….

Anyway, tallying up all the figures she will maintain her spending power. Her mortgage is paid, and she has some savings. Her income stream from 2013 onward, when the rest of France will struggle under the creativity of Mr Hollande and his regime, will flow from a tidy combination of her severance package, the unemployment insurance, a nip into her savings – and the fact that she will be paying no taxes.

And this – a clarion call that could easily echo throughout the cities and villages of the increasingly burdened Hexagone – is how you deal with the French economy.